From the weekly food shop to monthly energy bills, money feels louder than it used to. You may earn a decent living and still feel unsettled about where it all goes.

That unease shows up whether you work full-time or juggle freelance projects. You may be looking at your options, like self-employed loans, to smooth cash flow. A workable home budget gives you clarity and steadiness, making everyday decisions feel lighter.

Why A Realistic Budget Matters Now

You might be a freelancer or contractor. You might face uneven pay cycles. Maybe you just find yourself using credit cards as the month nears its end. Rising costs affect everyone.

And it’s more important now than ever to be on top of budgets. By putting boundaries in place, you control what goes in and out.

Think of a budget as a set of guardrails that keep your finances on the road rather than a cage that restricts you.

In the end, you gain confidence to say yes to plans because you know what you can afford.

Over time, certainty supports better choices. You can easily focus on building savings and avoiding short-term borrowing that costs more than it may seem.

Get A Clear Picture Of Your Income And Spending

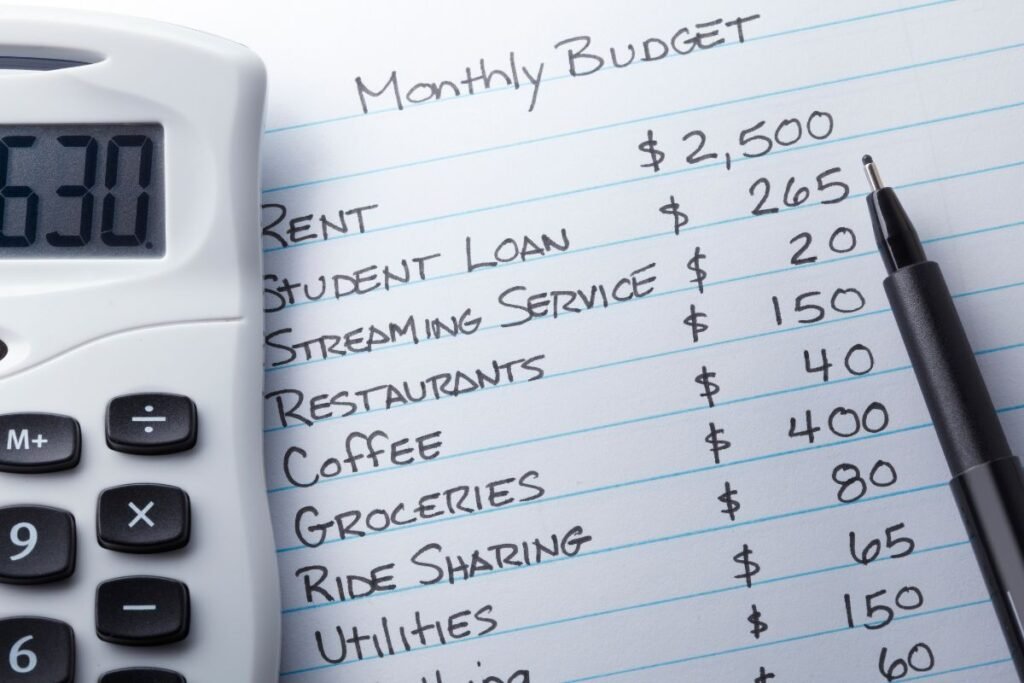

A workable budget starts with facts rather than feelings. Many people believe they know where their money goes, yet small, frequent payments like gym subscriptions often blur together.

The best way to stay on top of it is to write down every source of income and every outgoing over a full month, using bank statements rather than memory.

This exercise often provides useful insights that give you control. When you see patterns, you can adjust them with intention rather than guilt.

Someone who spends £60 a week on lunches at work, for example, may choose to bring food in twice a week and redirect the saved £480 a year towards holidays or an emergency fund.

Build A Budget You Can Actually Stick To

The best budget fits around your habits. Some people like a simple split between essentials, lifestyle spending, and savings and investment, while others prefer to allocate money to categories that mirror real life, such as transport, socialising, food, and health. Choose a structure that matches how you think about money, so you don’t resent maintaining it.

Allowing room for enjoyment keeps your plan alive. If you cut all discretionary spending, the budget often collapses within weeks.

For instance, setting aside £100 for social plans means you can meet friends without second-guessing every drink.

That freedom makes consistency easier, and consistency matters more than perfection when you want long-term change.

Making Your Budget Work Month After Month

A good budget isn’t something you set once and forget. Life changes, and so should your plan.

Maybe your rent goes up, your energy provider raises rates, or you take on a new client that shifts your income pattern.

Review your budget monthly at first, then every few months when things feel steadier. These quick check-ins keep you accountable and help you adjust before small changes snowball into bigger issues.

Technology can also make this easier. Free budgeting tools and bank apps now track spending automatically, showing trends in categories like dining out, subscriptions, or travel.

Using these insights is like looking in a financial mirror—it helps you see what’s really driving your habits.

Some people create a “spending diary” for a week or two, noting how each purchase felt. This adds an emotional layer to the numbers, helping you spot impulsive spending triggers or areas where you overspend for short-term comfort.

It also helps to give every pound a purpose. Even small windfalls, such as tax rebates or freelance bonuses, can be allocated smartly—part to savings, part to enjoyment, and perhaps a small slice toward debt repayment. This blend keeps your progress sustainable and your motivation intact.

Dealing With Debt And Where To Get Extra Help

Debt complicates budgeting because interest pulls money away before you can use it elsewhere. Credit cards and overdrafts often feel manageable until rates rise or income dips.

A clear budget shows how much spare cash you truly have and helps you decide which balances to tackle first.

Speak to a free debt adviser if repayments already feel overwhelming, as organisations like Citizens Advice offer practical guidance without judgement.

Finally, try to view budgeting as permission rather than restriction. Knowing your financial boundaries gives you greater freedom to make decisions that fit your goals.

A working budget doesn’t just stretch your money—it shapes a calmer, more confident relationship with it.